Does This Sound Familiar?

I can't really tell what to expect anymore

You create a monthly budget, then car repairs, medical bills, or holiday expenses completely blow it up. Every month feels like financial whiplash.

We are just shuffling money to where it was spent

You track every expense religiously, but you're always reacting after overspending instead of preventing it. Your budget feels more like financial archaeology than planning.

At most, I'll track expenses for a few days before I get overwhelmed and give up

Traditional budgeting demands perfection. Miss a few transactions and the guilt becomes so overwhelming you abandon the whole system.

Imagine Your Life When Your Budget Actually

Works With Your Reality

Confident Financial Decisions

You know exactly how much you can spend because your AI budget has already accounted for that upcoming car maintenance and holiday gifts.

Effortless Money Management

No more scrambling to 'shuffle money' after overspending. Your budget proactively adjusts, so you're always within your means.

Sustainable Financial Wellness

Finally break the cycle of budget abandonment. Your system works even when life gets messy (which it always does).

What if instead of forcing your chaotic life into a rigid budget...

Your budget could intelligently adapt to your actual spending patterns? That's predictive budgeting.

PredictBudget: The AI That Knows Your Money Better Than You Do

1. Connect & Learn

1. Connect & Learn

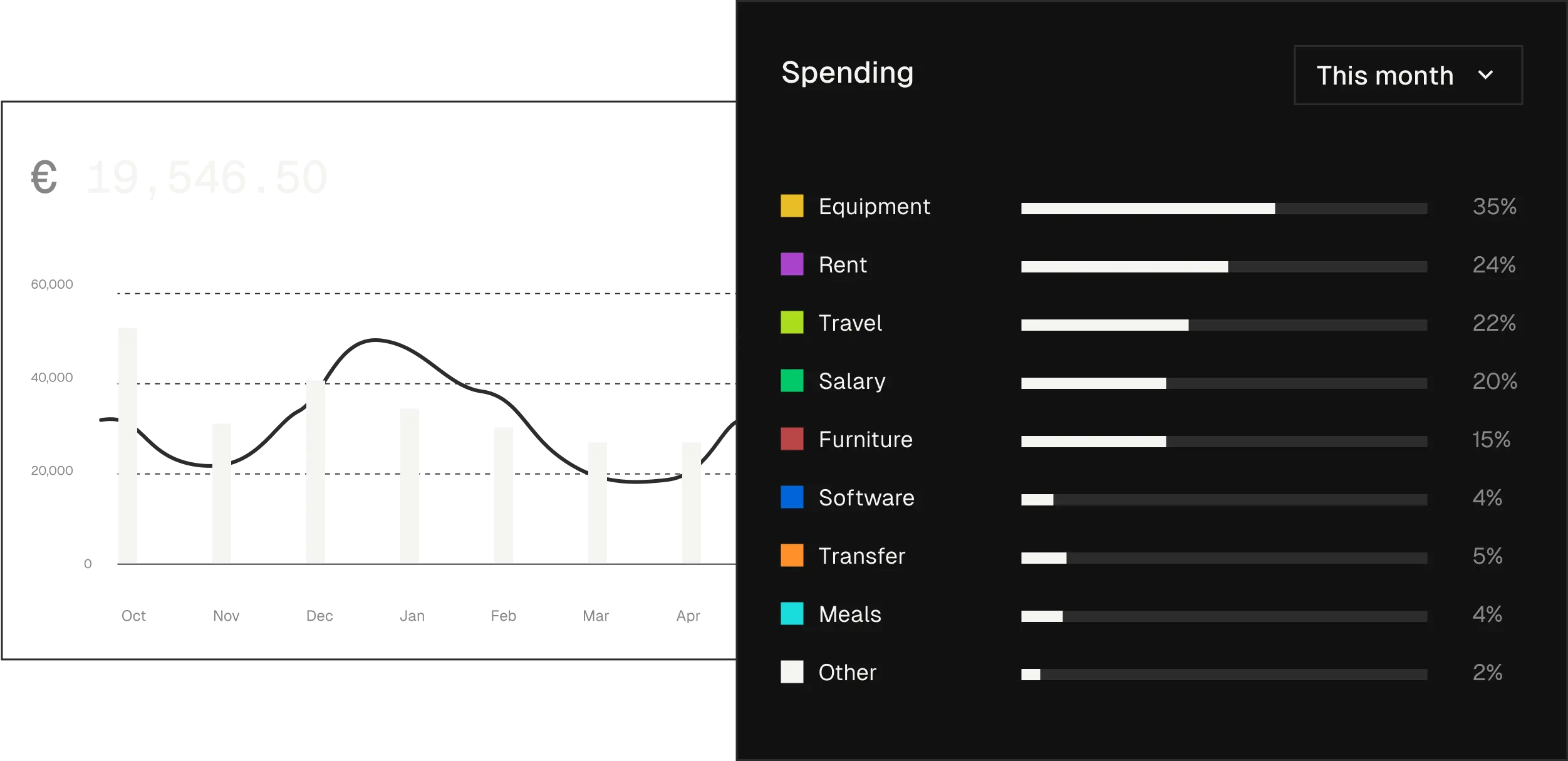

Link your accounts (securely) and let our AI analyze your spending patterns over time

2. Predict & Adjust

2. Predict & Adjust

AI identifies patterns in your 'irregular' expenses and proactively adjusts your budget

3. Stay on Track

3. Stay on Track

Get personalized alerts and suggestions before overspending, not after

Get early access

Be among the first to get access!